LEGAL ALERT

Penalty Rates Decision

1 March 2017

The Fair Work Commission has delivered its long-awaited decision concerning penalty rates in the hospitality, retail and fast food industries. In a complex decision that will apply differently to different classes of employees, the Commission decided to reduce Sunday and public holiday penalty rates for hospitality, retail and fast food workers as set out below. Saturday penalties will not be changed.

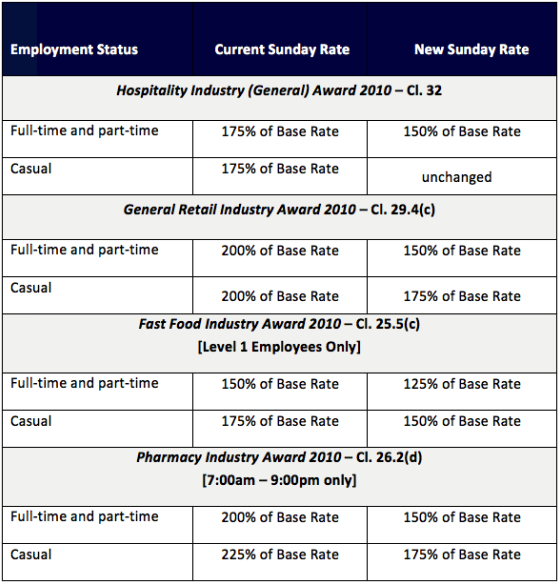

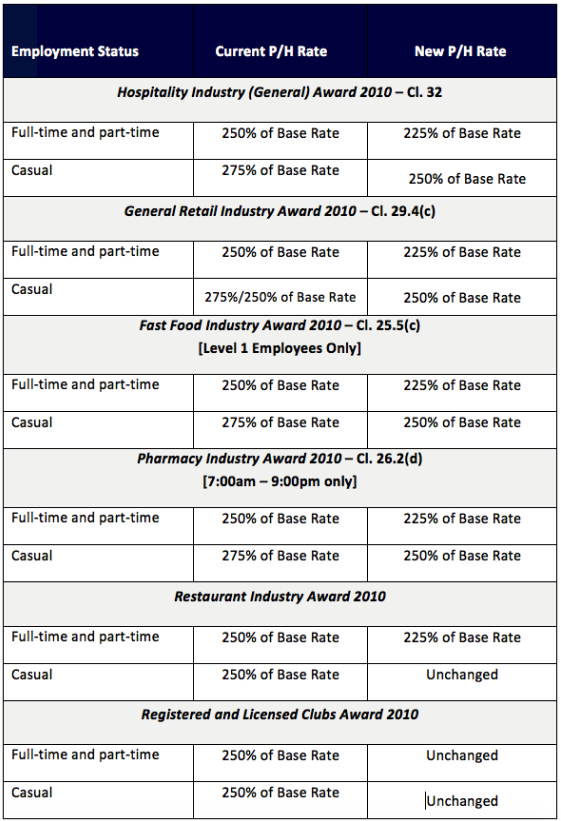

The tables below summarise the pending changes to Sunday penalty rates and public holiday penalty rates. Actual rates require careful attention, particularly in the case of casual employees. Careful regard must always be had to the applicable modern Award.

CHANGES TO SUNDAY PENALTY RATES

CHANGES TO PUBLIC HOLIDAY PENALTY RATES

The Commission is yet to fully determine how or when the changes to Sunday Penalty Rates will be implemented, other than to signal it will phase in the Sunday penalty rate changes in at least two instalments. It is likely that adjustments will be annual, at the same time the Commission makes its decisions on minimum wages on 1 July every year. The Commission will hear submissions on the necessary transitional arrangements.

The public holiday penalty rate changes will take effect from 1 July 2017.

Additional changes to the late night work loadings in the Restaurant Industry Award 2010, the Fast Food Industrial Award 2010 and the early morning work loading in the Restaurant Industry Award 2010 will commence operation on 27 March 2017.

Please enquire with EMA Legal if you need specific advice as to how this decision affects you. The exact timing and method of implementing the changes will be subject to further orders by the Commission. Changes to Award rates will not reduce existing obligations under enterprise agreements and individual employment contracts.

Please click here to view the full decision.

Latest News

Categories

Archives

This Newsletter is made available to our clients and interested parties to provide immediate access to information about important changes and developments relevant to employers. The information contained in this publication should not be relied on as legal advice and should not be treated as a substitute for detailed advice that takes into account particular situations and the particular circumstances of your business.